Coindesk describes an “oracle” this way…

…which is fairly easy to wrap your head around. So, it is a way of communicating precise values to a blockchain in order to resolve smart contracts, make adjustments based on prices, etc.

The reality, though, is that it is often an extremely complicated process that involves a lot of work being done under-the-hood so that data is updated where it needs to be & when it needs to be, and hopefully with a high degree of accuracy.

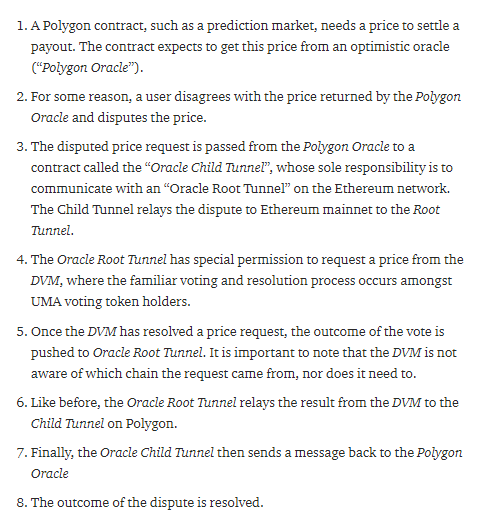

One Chainlink competitor, UMA, describes below their dispute resolution process for handling accusations of inaccurate data, across the Polygon bridge. They’re currently working on easing deployment & functionality to any EVM-compatible chains/layers – but this is basically the dispute process, every time, regardless.

Did you catch all of that? If so, congratulations – you’re in the 1%. If not, don’t feel too bad – this should all be happening under the hood, and without the need for you to do much of anything, unless you dispute the accuracy of oracles’ data.

Generally? Very accurate. They have to be, as they’re often servicing DeFi projects which may or may not be aware of all possible attack vectors. For instance, a lot of projects tried out “Flash Loans”, but quickly realized that having Uniswap be solely responsible for the majority of their volume, and adding in flash loans – meant that someone could very easily manipulate the price to great effect. Hence, “Flash Loan Attacks”, and a slew of projects eating dirt before realizing they might need Chainlink.

The bigger concern, as posited by notorious shit-stirrer Eric Wall, is if a concentrated effort is made by multiple bad actor oracles, or even several oracles under one umbrella – to manipulate data & confirm its accuracy.

Imagine a decentralized margin-trading protocol that relies on oracle data, and suddenly they start getting prices that are way off-base. If they’re only relying on Chainlink for that data, then a malicious actor with enough pull could effectively 100x at their own discretion & cash out with as big a win as is manageable.

This is where cryptoeconomic theory ought to kick in & prevent malicious actors from being able to steal more than they stand to lose – but again, as Eric Wall argues, Chainlink’s solution doesn’t quite manage that, leaving a hole for a potential competitor down the road.

But, for right now? There isn’t another project within sniffing distance of Chainlink, in terms of projects served & market cap. As ever, do your own research – but be aware of any potential risks, not only if you’re investing directly in oracle projects, but also if you’re investing in projects that may have to utilize oracles.

Torrent/seedbox aficionado, decentralist, cultural archivist, fundamental analyst, podcast addict, shitcoin-sifter extraordinaire

Tip Jar

BTC: bc1qahxrp47hpguhx8y8r382dekgca34tlv54aufht

Doge: DJRy9gGSUGeyXfVcZXzKLkBv7RmDLv3MhJ

Share This Article

Join 10,000+ forward thinkers! Get crypto education in your inbox.